Key Points

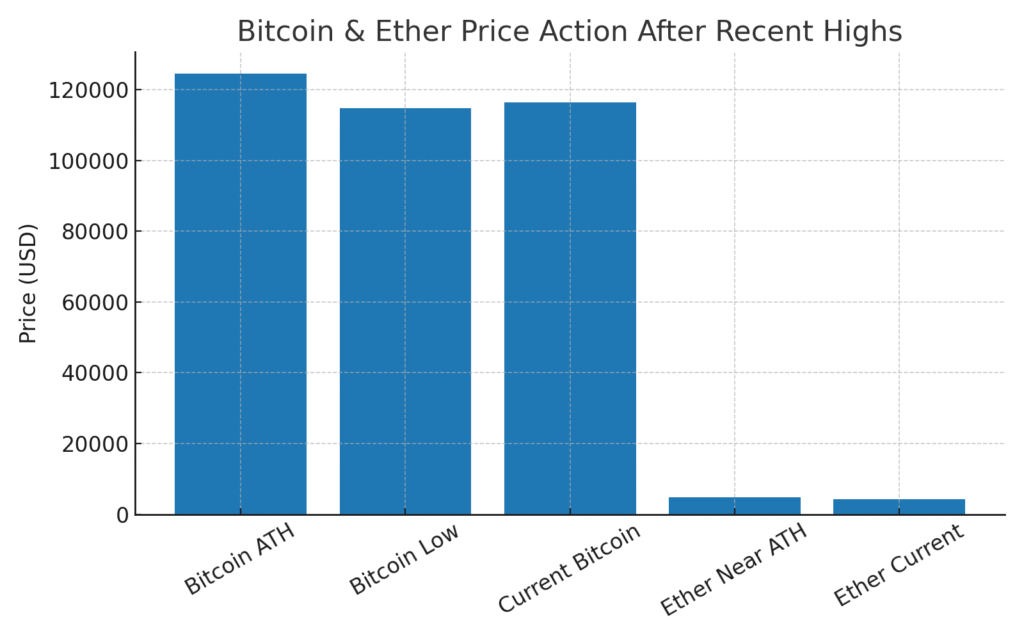

• Bitcoin fell to $115,000 after touching a new all-time high last week, its fourth one this year, near $125,000.

• Investors’ profit-taking triggered more than $530 million in liquidations over the past 24 hours.

• Macro concerns are expected to steal focus from the institutional adoption narrative this month and through the September Fed meeting.

• The crypto market tumbled to begin the week as heightened macro concerns triggered more than $500 million in forced selling of long positions.

• Bitcoin last traded at $116,394.87, with Ether down 2.5% to $4,354.00 after nearing its $4,800 record.

Market Report

Bitcoin’s record-breaking momentum hit a sharp reversal this week as the world’s largest cryptocurrency slipped to lows near $115,000, just days after notching a fresh all-time high around $124,500. The pullback, which erased nearly $10,000 in value within days, came as investors rushed to lock in profits and macroeconomic concerns triggered a wave of forced liquidations.

Data from CoinGlass shows more than $530 million in positions were liquidated over the past 24 hours, including roughly $124 million in long Bitcoin positions and $184 million in Ether longs. This liquidation cascade pushed prices further downward, with Bitcoin briefly touching $114,706 before recovering slightly to $116,394. Ether also saw losses, sliding 2.5% to $4,354 after coming within striking distance of its $4,800 record last week.

The downturn coincided with hotter-than-expected July wholesale inflation data, raising fresh doubts about whether the Federal Reserve will deliver a September rate cut. Adding to the unease were remarks from Treasury Secretary Scott Bessent, who confirmed that President Donald Trump’s strategic Bitcoin reserve plan would be limited to forfeited assets, delaying hopes of large-scale federal Bitcoin accumulation.

Crypto equities reflected the market turmoil as well. Bitmine Immersion sank 5.4%, while newly-listed exchange Bullish fell 8.9%. Meanwhile, Coinbase and Galaxy Digital bucked the trend, posting modest gains of 1% and 2.2% respectively.

Despite the turbulence, many analysts argue the pullback represents a healthy cooldown rather than a crisis. Crypto ETFs continue to draw strong inflows, with Bitcoin funds recording $547 million and Ether funds a record $2.9 billion last week. Such institutional support suggests underlying demand remains resilient even as short-term macro factors dominate headlines.

Looking ahead, all eyes are on the Fed’s annual Jackson Hole symposium and upcoming jobless claims data, as traders search for clues on the central bank’s next policy moves. Until then, markets may continue to see heightened volatility as profit-taking and macro anxieties weigh on sentiment.

Price Action Snapshot