Dogecoin is once again under the spotlight after a massive 900 million DOGE transfer to Binance sent ripples through the meme-coin market.

While the move sparked fears of a broad sell-off, on-chain data suggests that behind the noise, whales remain net accumulators — setting up

a fascinating tug-of-war that could define DOGE’s next breakout.

Key Points Analysis

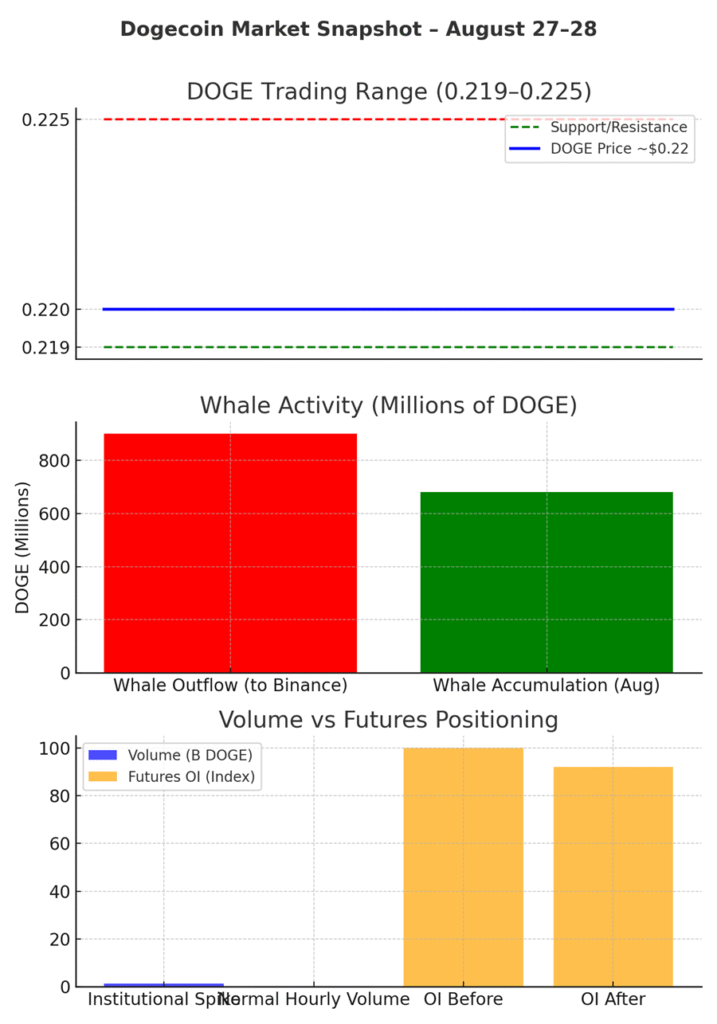

$200M Whale Transfer: Between August 24–25, a single whale moved 900 million DOGE ($200M) to Binance, prompting a sharp dip from $0.25 to $0.23.

Accumulation Continues: Despite the transfer, August saw 680 million DOGE accumulated by whales, hinting at strategic positioning rather than outright distribution.

Price Compression: DOGE is locked in a narrow $0.219–$0.225 range, showing signs of consolidation before a potential breakout.

Futures Weakness: Open interest dropped 8%, reflecting lighter speculative positioning — dampening volatility but also reducing conviction for near-term rallies.

Macro Influence: Fed Chair Jerome Powell’s Jackson Hole remarks briefly fueled a meme-coin rally, but DOGE has since cooled into its $0.22 band.

Price Action Recap

Aug. 27, 20:00 GMT: DOGE spiked from $0.219 → $0.224 on 1.26B volume — nearly 4x average hourly flows, signaling institutional absorption.

Late session (Aug. 28, 01:20–02:19 GMT): DOGE again tested $0.224 highs before slipping back to $0.220–$0.221 as sellers re-emerged.

Net result: DOGE traded within a tight 3% range, reinforcing a compression phase.

Technical Landscape

Support: $0.219–$0.220 is holding firm as the new floor.

Resistance: $0.224–$0.225 has repeatedly capped intraday rallies.

Momentum: RSI stuck mid-50s → market equilibrium, no decisive bias.

Volume: Institutional spikes contrast with overall declining activity — consolidation remains dominant.

Pattern Watch: Tight range compression → setup for volatility expansion.

What Traders Are Watching Next

Support test: Can $0.219 hold if more whale distributions hit exchanges?

Breakout zone: Above $0.225 could unlock a move toward $0.23–$0.24.

Corporate desks: Signs of sustained accumulation near $0.22 may reflect treasury strategy.

Futures leverage: If open interest revives, the next move could be amplified.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.