Ethereum is once again taking center stage in the institutional trading arena, as CME’s Ether (ETH) futures market notched a record-breaking $10 billion in open interest. This surge underscores a renewed wave of confidence from Wall Street and global funds, marking a pivotal moment in ETH’s evolving role within the broader crypto landscape.

Key Points Analysis:

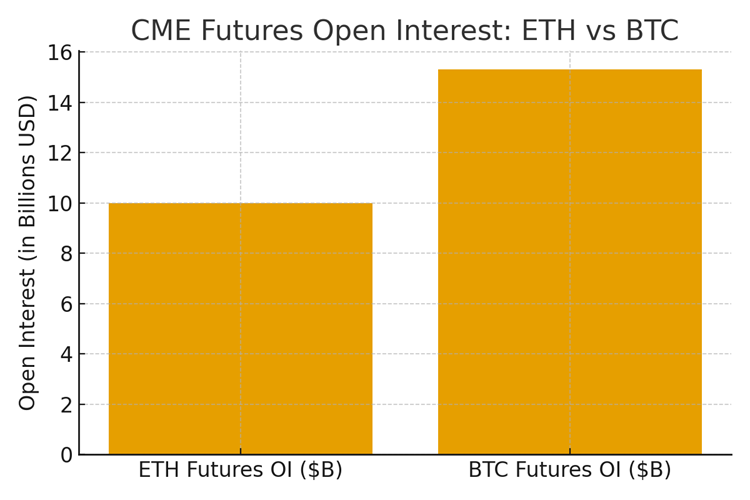

Ether futures open interest on CME surpassed $10 billion — a record high.

Institutional activity is evident, with large holders of ETH futures contracts reaching 101, the highest ever.Ether surged 23% this month, briefly crossing $4,900 and setting new lifetime highs.

Rotation out of Bitcoin continues, with BTC futures open interest subdued compared to Ether.

CME micro-Ether contracts exceeded 500,000 open positions, while Ether options open interest topped $1 billion.

U.S.-listed spot ETFs added $3.69 billion to ETH in August, extending a four-month inflow streak.

Bitcoin ETFs, meanwhile, recorded net outflows of $803 million, signaling cooling demand.

The record-breaking momentum in Ether’s derivatives market signals a clear message: institutional money is rotating into ETH as the network cements itself beyond Bitcoin’s shadow. With record inflows into ETFs, booming futures activity, and strengthening options markets, Ethereum is rapidly proving to be the favored institutional play for the next wave of digital asset growth.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.