Ethereum just delivered its most active month in years — and the numbers are staggering.

According to fresh data , Ethereum’s adjusted onchain transfer volume surged above $320 billion in August, the network’s highest monthly throughput since May 2021 and the third-largest on record. This marks a powerful comeback for the world’s leading smart contract blockchain, underscoring a resurgence in adoption, liquidity, and institutional demand.

Key Points Driving the Ethereum Surge

Onchain Activity Boom: 30-day transactions hit all-time highs, monthly active addresses logged their second-strongest month ever, and total value locked (TVL) remains close to record peaks.

Corporate Treasuries Double Down: Public companies expanded their Ether holdings from $4B to $12B in August, with big contributions from BitMine Immersion and SharpLink Gaming.

ETF Tailwinds: Spot ETH ETFs recorded heavy late-month inflows, now collectively holding more than 5% of Ethereum’s supply.

Ultra-Cheap Fees: Transaction costs hit multi-year lows, supercharging usage. This stems from March’s Dencun upgrade (EIP-4844, aka proto-danksharding) and this year’s Pectra release, both improving scalability and user experience.

Validator Shakeup: Record validator exits paired with a two-year high in new entries, as liquid restaking protocols drew tens of billions in deposits.

Wall Street Notice: Analysts at Standard Chartered argue ETH remains undervalued, pointing to corporate adoption and ETF demand as key catalysts.

Ethereum in the Market

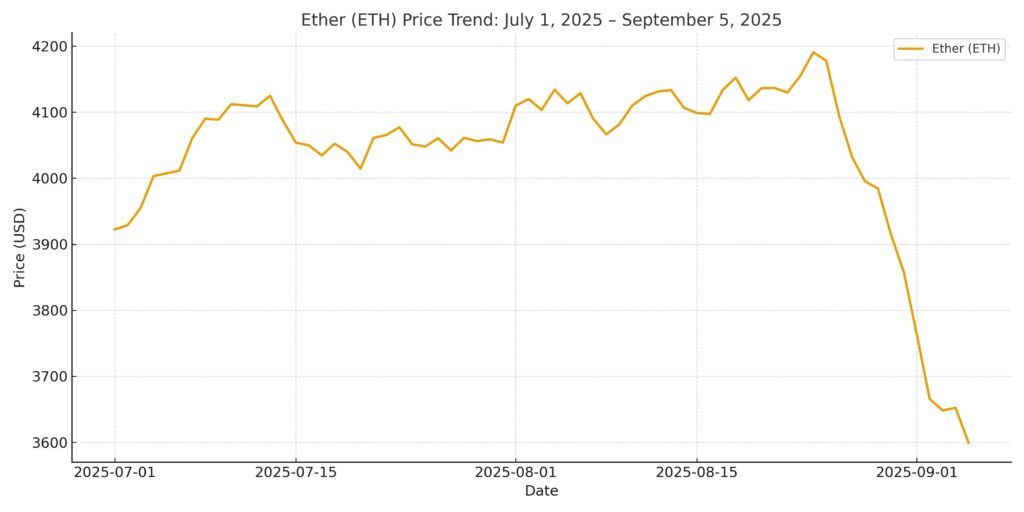

Despite the onchain fireworks, ETH has not escaped recent market turbulence. As of Friday, ETH traded around $4,337 — down 5% on the day and 12% below its all-time high. Still, with capital rotation from Bitcoin whales, strong ETF flows, and government experiments using Ethereum as a settlement layer for macroeconomic data, the network continues to position itself as a backbone of global finance.

Ethereum’s August surge is more than a statistical anomaly — it’s a signal. With corporate balance sheets, ETFs, and cheaper fees converging, the blockchain may be entering its next phase of mass-scale adoption.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards.