Solana’s decentralized exchange (DEX) ecosystem is losing steam as retail traders grow wary of meme coin scams, with August extending a troubling year-long decline in activity.

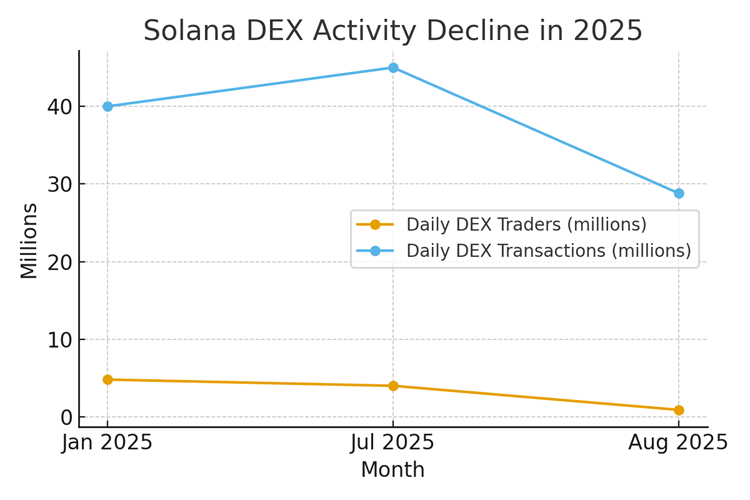

Daily active traders on Solana DEXs have collapsed from a staggering 4.8 million at the start of 2025 to just 900,000 in August, according to fresh data. Transaction volumes tell a similar story, plunging nearly 50% from a July high of 45 million to just 28.8 million last month.

Meme Coin Frenzy Turns to Scandal

Analysts say the “collapse of extractive meme coins” is the primary driver of this retreat. These tokens, often launched with celebrity hype or fake endorsements, fueled retail speculation but have increasingly devolved into pump-and-dump schemes.

Instagram hijacks: Hackers compromised the accounts of celebrities including Adele, Future, Tyla, and even Michael Jackson’s estate to shill FREEBANDZ, a fake Solana token that later crashed 98% in value.

Fake CR7 token: A counterfeit coin linked to Cristiano Ronaldo skyrocketed to a $143 million market cap in minutes before insiders drained liquidity.

Kanye West token chaos: Hackers used West’s Instagram to push a fake YZY token, tanking his official coin by 81% after he confirmed the hack.

These scandals have chipped away at Solana’s reputation as the “retail chain” of crypto, raising concerns about sustainability.

Retail Exodus, Whales Dominate

The decline in everyday traders has coincided with rising whale dominance, leaving Solana vulnerable to volatility. Ryan Lee, chief analyst at Bitget, warned that the network’s heavy reliance on volatile meme coin activity could undermine long-term growth unless it builds out deeper DeFi use cases.

At the same time, Solana’s market share of DEX trading volume tells a story of sharp swings. The chain’s share tumbled from 76% in January to just 8% by June, largely due to a rotation into BNB-based DEXs. Encouragingly, it has since recovered to around 27%, according to Max Shannon of Bitwise Europe.

“Solana still has the best capital efficiency at scale,” Shannon said, adding that its roadmap for greater throughput and lower costs positions it strongly against Ethereum and other rivals.

The Bigger Picture

Despite retail retreat, Solana’s fundamentals remain intact, and its token is riding bullish momentum—up 1.8% on the day at $215, and more than 15% over the past week.

Key Takeaways for Investors:

Retail trust is weakening due to relentless meme coin scams.

Whale dominance is reshaping Solana’s trading dynamics.

Strong fundamentals and capital efficiency keep Solana competitive in the long term.

rowth may hinge on moving beyond meme coins into broader DeFi and institutional adoption.

Solana may be battered by retail outflows, but with a strong recovery in market share and a roadmap built for scale, the network still has plenty of fight left in it. The question now: can it evolve fast enough to shake off its meme coin stigma?